Interested in a Renovation Loan? Contact us today or Get Started here.

Boost your home's value with renovations that are worth the effort and cash. Here are a few of the top projects that could give you the most value in the long run.

A good first step would be to refinish hardwood floors, cabinetry, walls, windows, woodwork, and counters. If budget permits, replace fixtures and hardware to round out your finishes.

Investing some money into refreshing the look of your bathroom could help increase your home’s value and may be a big selling point.

Boost your curb appeal with an upgraded outdoor area.

If you are considering refinancing be sure to do your research. Focus on long-term costs and benefits based on the equity in your home, the terms of the new and exsisting loans, and the break-even point at which you will recover your costs.

The following sources are deemed reliable but not guaranteed:

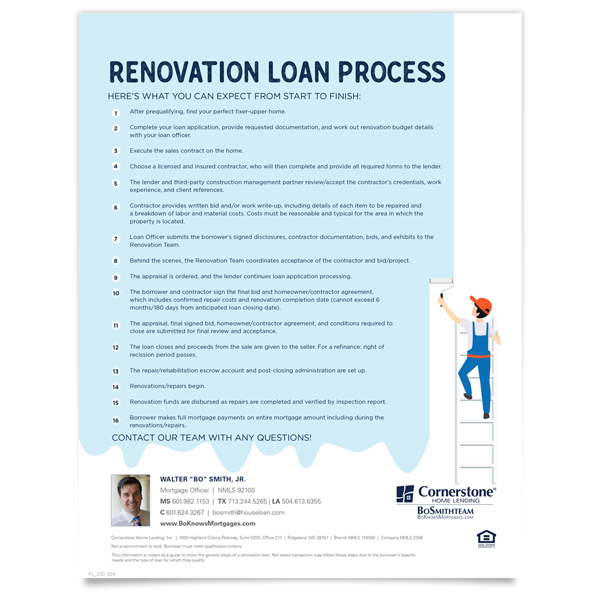

Renovation Loan Process